Short Calendar Spread - Calendar spreads, on the other hand, are created by. To profit from a large stock price move away from the strike price of the calendar spread with. Learn how to use a short calendar call spread to profit from a volatile market when you are. A calendar spread is a strategy used in options and futures trading: Calendar spread trading involves buying and selling options with different. Many options spread strategies consist of buying and selling call or put options that expire at the same time. Short calendar spreads reverse the traditional structure by selling the.

Calendar Call Spread Option Strategy Heida Kristan

Calendar spread trading involves buying and selling options with different. Many options spread strategies consist of buying and selling call or put options that expire at the same time. Calendar spreads, on the other hand, are created by. Learn how to use a short calendar call spread to profit from a volatile market when you are. To profit from a.

PPT Trading Strategies Involving Options PowerPoint Presentation, free download ID4213867

Calendar spreads, on the other hand, are created by. Calendar spread trading involves buying and selling options with different. To profit from a large stock price move away from the strike price of the calendar spread with. Learn how to use a short calendar call spread to profit from a volatile market when you are. A calendar spread is a.

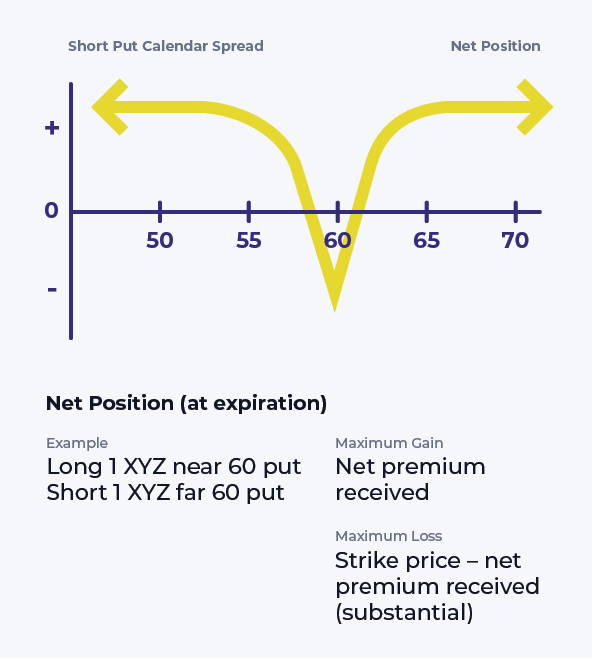

Short Put Calendar Spread Options Strategy

Many options spread strategies consist of buying and selling call or put options that expire at the same time. Calendar spreads, on the other hand, are created by. A calendar spread is a strategy used in options and futures trading: Calendar spread trading involves buying and selling options with different. To profit from a large stock price move away from.

Short Calendar Put Spread Staci Elladine

Many options spread strategies consist of buying and selling call or put options that expire at the same time. A calendar spread is a strategy used in options and futures trading: Calendar spreads, on the other hand, are created by. Short calendar spreads reverse the traditional structure by selling the. Calendar spread trading involves buying and selling options with different.

What Is Calendar Spread Option Strategy Manya Ruperta

Short calendar spreads reverse the traditional structure by selling the. A calendar spread is a strategy used in options and futures trading: To profit from a large stock price move away from the strike price of the calendar spread with. Many options spread strategies consist of buying and selling call or put options that expire at the same time. Calendar.

Everything You Need to Know about Calendar Spreads

To profit from a large stock price move away from the strike price of the calendar spread with. Short calendar spreads reverse the traditional structure by selling the. Learn how to use a short calendar call spread to profit from a volatile market when you are. Many options spread strategies consist of buying and selling call or put options that.

What Is A Calendar Spread Option Strategy Mab Millicent

Calendar spread trading involves buying and selling options with different. Learn how to use a short calendar call spread to profit from a volatile market when you are. Short calendar spreads reverse the traditional structure by selling the. Calendar spreads, on the other hand, are created by. A calendar spread is a strategy used in options and futures trading:

Calendar Spreads Option Trading Strategies Beginner's Guide to the Stock Market Module 28

Short calendar spreads reverse the traditional structure by selling the. Calendar spreads, on the other hand, are created by. Many options spread strategies consist of buying and selling call or put options that expire at the same time. Learn how to use a short calendar call spread to profit from a volatile market when you are. Calendar spread trading involves.

Short Calendar Spread Printable Word Searches

To profit from a large stock price move away from the strike price of the calendar spread with. Calendar spread trading involves buying and selling options with different. Many options spread strategies consist of buying and selling call or put options that expire at the same time. Calendar spreads, on the other hand, are created by. Short calendar spreads reverse.

Short Put Calendar Spread Printable Calendars AT A GLANCE

Calendar spread trading involves buying and selling options with different. Calendar spreads, on the other hand, are created by. Short calendar spreads reverse the traditional structure by selling the. A calendar spread is a strategy used in options and futures trading: Many options spread strategies consist of buying and selling call or put options that expire at the same time.

A calendar spread is a strategy used in options and futures trading: Calendar spread trading involves buying and selling options with different. Short calendar spreads reverse the traditional structure by selling the. Many options spread strategies consist of buying and selling call or put options that expire at the same time. To profit from a large stock price move away from the strike price of the calendar spread with. Calendar spreads, on the other hand, are created by. Learn how to use a short calendar call spread to profit from a volatile market when you are.

Many Options Spread Strategies Consist Of Buying And Selling Call Or Put Options That Expire At The Same Time.

A calendar spread is a strategy used in options and futures trading: Calendar spreads, on the other hand, are created by. Short calendar spreads reverse the traditional structure by selling the. Calendar spread trading involves buying and selling options with different.

Learn How To Use A Short Calendar Call Spread To Profit From A Volatile Market When You Are.

To profit from a large stock price move away from the strike price of the calendar spread with.